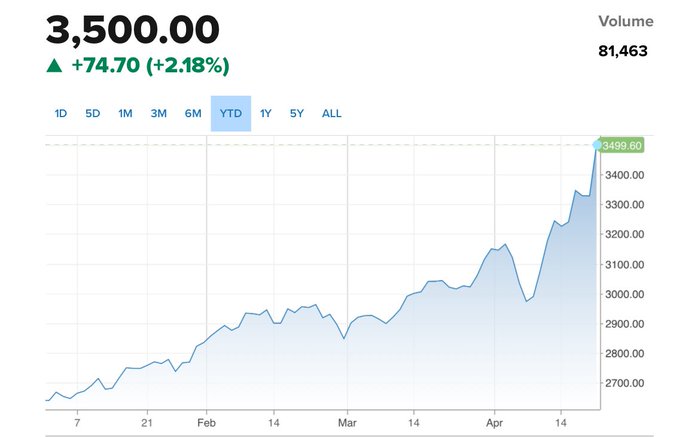

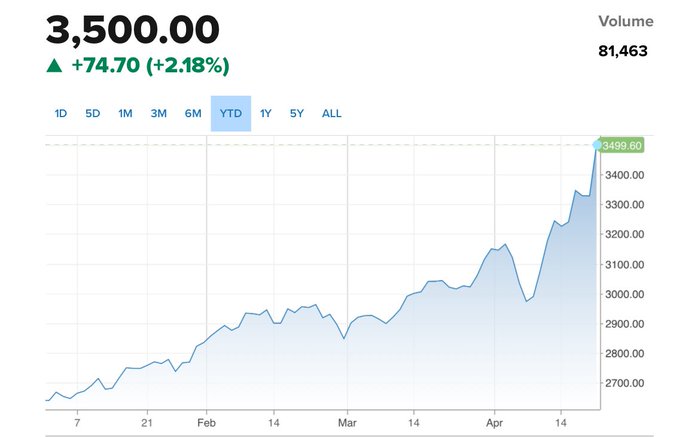

Since April 8 (when the price of gold was still below $3,000), the international gold price has been able to pass a "barrier" of $100 every two trading days on average.

Alex Deluce, an analyst at GoldTelegraph, recently wrote that the global financial system is not only changing, but the old order is beginning to collapse. The status of the US dollar as the world's reserve currency is no longer so unquestionable. For many years, Deluce has been recording the growing dangers of the West's over-reliance on financial weapons. These financial weapons report sanctions, reserve freezes, and the weaponization of the SWIFT system. Deluce believes that these are not diplomatic strategic tools, they are early signs of deeper problems: despair, fragility, and a shaky world order.

Deluce said that in the past year alone, driven by record central bank gold purchases, the purchasing power of the US dollar against gold has fallen by more than 35%. This is not a trend, but a signal. At the same time, the BRICS countries are strengthening coordination, while the rifts between traditional Western allies are widening. From Europe to Asia, leaders are reassessing their risks in a dollar system that is no longer stable. More and more countries are recognizing that true monetary sovereignty begins with one principle: zero counterparty risk - and that path leads directly to gold.

Deluce said that as trust disappears, gold is no longer just a safe haven. It is becoming the foundation of a new system - a common conclusion he recently reached in an exchange with VON GREYERZ partner Matthew Piepenburg. The safe haven status of US bonds is weakening. Gold becomes the ultimate safe haven. For the past few decades, US Treasuries have been the cornerstone of the global financial system and are regarded as the ultimate safe haven by investors and institutions. But this month, this statement is clearly disappearing. Piepenburg believes that there is now a liquidity crisis, and "the lubrication of this system is no longer enough to keep it running."

Far from providing stability in turbulent times, US government bonds have begun to behave more like risky assets. In the market turmoil earlier this month, US Treasury yields rose when they should have fallen under normal circumstances, highlighting the increasing fragility of the system.

Shanghai Nonferrous Network

https://news.smm.cn/news/103292437